Ghana is set to launch the highly anticipated Ghana Gold Coin (GGC), providing residents with a new investment opportunity. Dr. Steve Opata, an advisor at the Bank of Ghana, announced during an interview on Metro TV’s Bottomline program on September 30, 2024, that individuals interested in purchasing the coin will need a minimum of GH¢10,000.

What is the Ghana Gold Coin (GGC)?

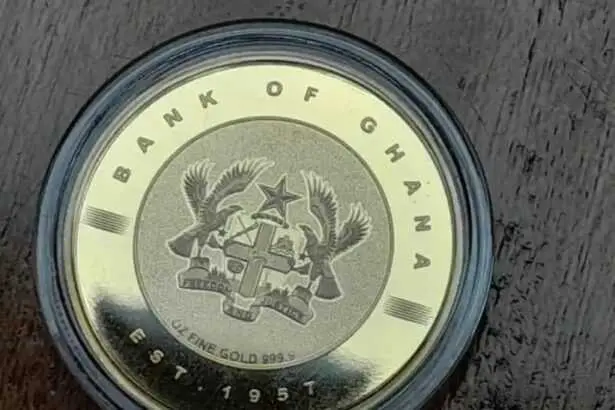

The Ghana Gold Coin is a premium investment option made from responsibly mined gold in Ghana, refined to 99.99% purity. Issued and guaranteed by the Bank of Ghana (BoG), the coin will be available in three sizes: 1 oz, 1/2 oz, and 1/4 oz, providing flexibility for investors. Each coin features the Ghana Coat of Arms on one side and the iconic Independence Arch on the other, symbolizing national pride and economic growth.

Pricing and Availability

The price of the GGC will be based on the London Bullion Market Association (LBMA) Auction Price from the previous day, along with the exchange rate of the U.S. dollar against the Ghanaian cedi, using the previous day’s Bloomberg Mid-Rate. Prices will be updated daily and published on the BoG website.

Why Invest in the Ghana Gold Coin?

According to Dr. Opata, the introduction of the GGC is part of the BoG’s domestic gold purchase program. Investing in gold serves as a natural hedge against economic uncertainty, offering stability and a long-term store of value. The GGC aims to broaden access to this valuable asset and diversify the investment portfolios of local investors.

How to Buy the Ghana Gold Coin

Interested buyers can purchase the GGC through commercial banks. To buy a coin, individuals must place an order at their bank, specifying the desired weight and quantity. Payments must be made through bank or mobile money accounts; cash payments will not be accepted. Banks will facilitate transactions by opening gold accounts for their customers.

Can I Store the Coin Safely?

Buyers have the option to keep their physical coins or deposit them with their commercial bank for safekeeping, typically at a nominal fee.

How to Sell the Ghana Gold Coin

To sell the GGC, investors can check the current price on the BoG website or through authorized platforms and place a sale order with their bank. The BoG guarantees a buyback of the coin if banks are unable to facilitate the transaction, though certain conditions and discounts may apply.

Ensuring Authenticity

The GGC is equipped with Veriscan Technology, allowing buyers to verify the authenticity of the coin. Users can download the Veriscan app from the Apple Store, select the Bank of Ghana as the coin’s design, and scan the coin to confirm its authenticity.

Anti-Money Laundering Measures

The BoG has implemented strict anti-money laundering (AML) and counter-terrorism financing (CFT) measures to ensure that all transactions comply with national and international regulations. Commercial banks will closely monitor all transactions involving the GGC, ensuring that all buyers undergo identity verification and that the funds used are legitimate.

GhArticles.com Every News in Detail

GhArticles.com Every News in Detail