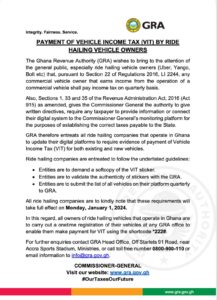

The Ghana Revenue Authority (GRA) has announced a significant change affecting ride hailing vehicle owners, including those associated with services like Uber, Yango, and Bolt. Effective from January 1, 2024, owners of commercial vehicles operating under ride hailing platforms are mandated to pay Vehicle Income Tax (VIT) in accordance with Section 22 of Regulations 2016, LI 2244.

This directive, in alignment with Sections 1, 33, and 35 of the Revenue Administration Act, 2016 (Act 915), grants the Commissioner General the authority to issue written directives, request taxpayer information, and link digital systems to the GRA’s monitoring platform to determine accurate taxes owed to the state.

Ride hailing companies in Ghana are urged to update their digital platforms to necessitate proof of VIT payment for both existing and new vehicles. The GRA has outlined specific guidelines for these entities, including the demand for a softcopy of the VIT sticker, validation of sticker authenticity through the GRA, and quarterly submission of vehicle lists to the GRA.

Owners of ride hailing vehicles operating in Ghana are required to complete a one-time vehicle registration at any GRA office to facilitate VIT payment using the shortcode “*222#.”

GhArticles.com Every News in Detail

GhArticles.com Every News in Detail