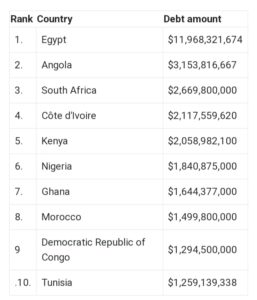

Ghana has claimed the seventh position among African nations grappling with substantial debts owed to the International Monetary Fund (IMF), according to the IMF’s latest data as of December 6th, 2023.

The IMF, a pivotal player in global finance, extends financial assistance to governments facing economic challenges. While these loans offer temporary relief to nations in economic distress, their ramifications can significantly impact economies, especially in regions where debt becomes unsustainable.

During severe economic crises, countries often turn to the IMF as a last resort to stabilize their financial systems. These loans act as crucial support during tumultuous economic times and can potentially boost a nation’s credibility among foreign investors, opening doors to increased foreign direct investment and improved access to global capital markets.

However, improper management or utilization of these loans can severely harm an economy. IMF loans typically come with stringent conditions, such as austerity measures involving reductions in public spending, subsidy cuts, and tax increases. Despite aiming to rectify fiscal imbalances, these measures often trigger social unrest and disproportionately affect vulnerable segments of the population.

Debt, regardless of its origin, places significant strain on any economy, necessitating responsible handling. Additionally, the conditions attached to IMF loans can inadvertently weaken a country’s exchange rate, impacting the strength of local currencies beyond desirable levels.

GhArticles.com Every News in Detail

GhArticles.com Every News in Detail