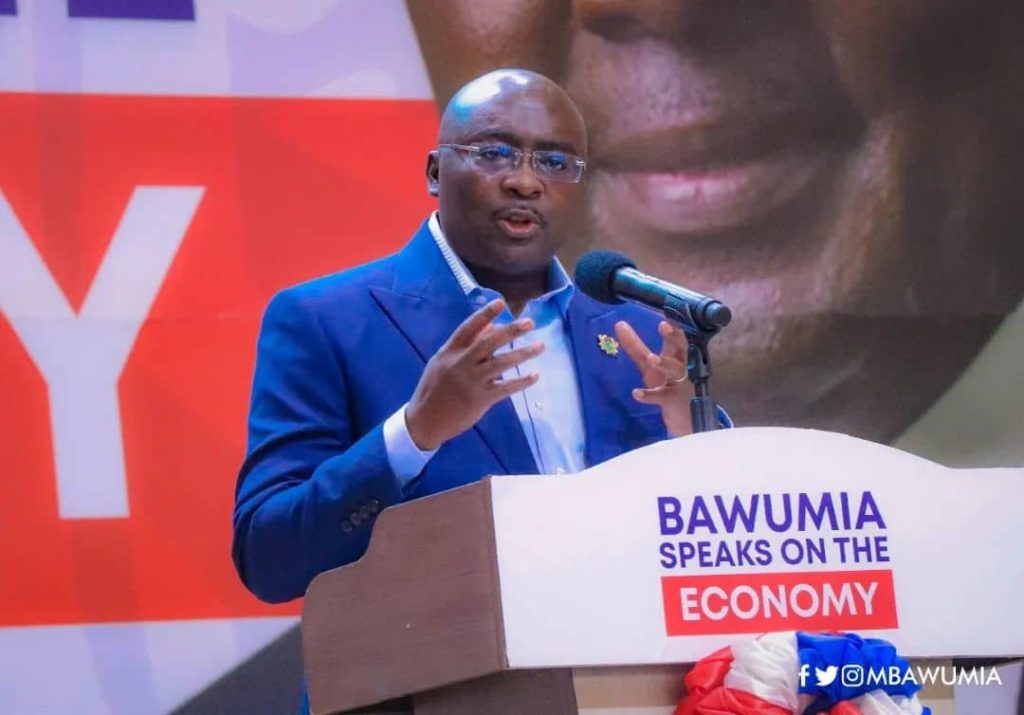

Vice President Dr. Mahamudu Bawumia has vowed to eliminate the controversial electronic financial transaction tax, commonly known as e-levy, should he ascend to the presidency of Ghana. Speaking in his inaugural address to the nation subsequent to clinching the flagbearer position for the New Patriotic Party (NPP), Dr. Bawumia reiterated his resolute opposition to levies on digital financial activities, underscoring his commitment to scrapping the e-levy if elected.

Advocating for a digitalized and cashless economy, Dr. Bawumia emphasized the imperative of incentivizing electronic payment systems, asserting that his proposed abolition of the e-levy would catalyze the realization of a Digital and Cashless Ghana.

“In order to facilitate the transition towards a cashless society, it is imperative that we promote the utilization of electronic payment platforms. To facilitate this transition, my administration will refrain from imposing taxes on digital transactions. Consequently, the e-levy will be eradicated,” Dr. Bawumia proclaimed.

Moreover, Dr. Bawumia disclosed his blueprint for a revamped tax framework under his potential administration, which would encompass the elimination of the emission tax, wagering levies, and the proposed 15% Value Added Tax (VAT) on electricity tariffs, slated for potential implementation by January 2025.

Additionally, he unveiled plans to introduce a simplified and taxpayer-friendly flat tax system tailored to both citizens and enterprises in Ghana, with a particular focus on bolstering support for small and medium-sized businesses (SMEs).

“My administration is committed to implementing a straightforward flat tax regime that is accessible to both citizens and businesses. This will entail the imposition of a uniform tax rate on income for individuals and SMEs, which constitute 98% of Ghana’s business landscape, alongside appropriate exemption thresholds to shield vulnerable segments of society,” affirmed Dr. Bawumia.

GhArticles.com Every News in Detail

GhArticles.com Every News in Detail