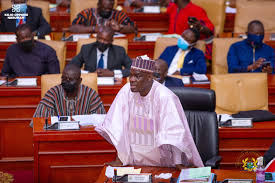

The Minority in Parliament of Ghana, led by Dr. Cassiel Ato Baah Forson, has declared a strong stance against proposed tax exemptions for 45 companies, citing concerns over the potential misuse of these exemptions for kickbacks and expressing alarm at the collective relief sought amounting to over 5.5 billion Ghanaian cedis.

Dr. Forson, highlighting the economic burden faced by Ghanaian taxpayers, asserted that the surge in companies seeking exemptions was alarming, with a total of 118 entities currently under consideration by various governmental bodies. The Minority expressed apprehension, branding these requests as “unconscionable” and suggestive of “organised crime.”

Referring to past incidents in Parliament, Dr. Forson emphasized concerns raised regarding due diligence in the process for tax waivers. The Minority Leader accused the Akufo-Addo government of directing attention towards manipulating tax revenues for alleged personal gains, alleging an unhealthy focus on granting tax exemptions to their affiliates.

The Minority Leader’s statement, released on November 27, 2023, painted a picture of an economy reeling under severe stress, urging Ghanaians to join in resisting what they characterized as an exploitation of the tax system. They voiced a strong determination to combat the current forms of tax waiver applications.

Furthermore, the Minority outlined their stance to support these waivers only on the condition that companies seeking exemptions should allocate a corresponding equity stake in their investment projects or businesses to the State, as per specific sections of the Exemptions Act, 2022 (Act 1083).

The statement concluded with a resolute call to action, rallying Ghanaians to unite against what the Minority deemed as the government’s practice of collecting taxes from citizens only to grant substantial exemptions to favored entities, leading to increased hardships for the population.

GhArticles.com Every News in Detail

GhArticles.com Every News in Detail