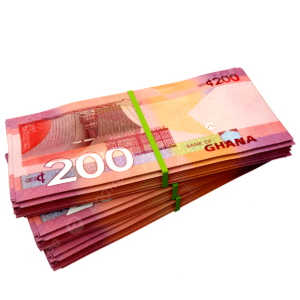

According to the Bank of Ghana’s latest report in November 2023, Ghana’s currency, the cedi, has experienced a significant depreciation of 25.8% against the US dollar.

The report highlighted a period of relative stability for the cedi between March and September 2023, trading between GHS 11.01 and GHS 11.13 against the dollar in the interbank foreign exchange market. However, in October and November, the cedi faltered, reaching GHS 11.50 and GHS 11.56 against the dollar, respectively.

Initially maintaining around a 22% depreciation rate since March, the cedi’s decline accelerated to 25.8% in November, escalating from 25.4% in October.

This depreciation trend extends to other major currencies, showing a 28.6% decline against the Pound and a 27.7% drop against the Euro during the same period.

Observers express concerns about the impact on the economy, especially during the festive season, predicting increased pressure on the cedi due to heightened demand for the dollar and substantial imports.

To mitigate this, experts suggest the timely release of the cocoa syndicated loan and the second tranche of the IMF bailout as potential measures to stabilize the cedi and alleviate pressure on the local currency.

The government faces mounting calls to implement long-term strategies to counteract this trend, emphasizing the urgency of addressing the currency’s depreciation for sustained economic stability.

GhArticles.com Every News in Detail

GhArticles.com Every News in Detail